As Bitcoin (BTC) continues its upward trajectory, several indicators suggest that it may soon surpass the $100,000 threshold. These signals, ranging from institutional investments to on-chain metrics, paint a bullish picture for the cryptocurrency in the near term.

Discover the four key indicators suggesting Bitcoin may surpass $100K soon

1. Institutional Investors and Whales Accumulate BTC

Recent data reveals a significant uptick in Bitcoin purchases by large-scale investors, commonly referred to as "whales." The Spot Average Order Size indicator shows substantial buy orders, indicating strong confidence in BTC's future performance.

Moreover, spot Bitcoin ETFs have experienced consistent inflows, reflecting sustained institutional interest. In the past month alone, approximately $4.49 billion worth of BTC was acquired, while only about $56 million was sold. This disparity underscores a robust accumulation trend, suggesting that major players are positioning themselves for anticipated price increases.

2. Exchange Reserves Hit Record Lows

According to CryptoQuant, the amount of Bitcoin held on exchanges has plummeted to approximately 2.47 million BTC. This decline indicates that investors are moving their assets to long-term storage solutions, such as cold wallets, signaling a shift towards holding rather than trading.

This reduction in readily available BTC on exchanges can lead to a supply squeeze, especially if demand continues to rise. Historically, such scenarios have preceded significant price surges, as limited supply meets increasing demand.

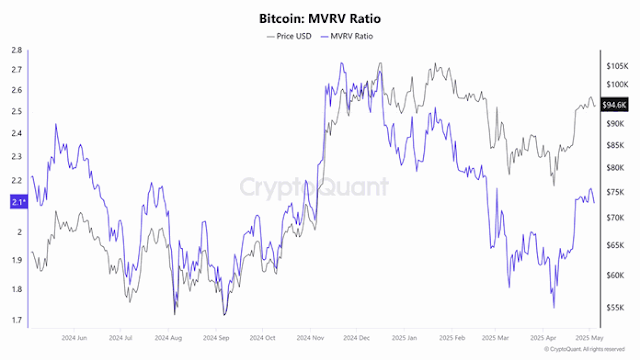

3. MVRV Ratio Suggests Further Growth Potential

The Market Value to Realized Value (MVRV) ratio, a metric used to assess Bitcoin's valuation, currently stands at 2.1. This figure is notably below the 3.7 level often associated with market peaks.

A lower MVRV ratio implies that Bitcoin is not yet overvalued, leaving room for further appreciation. This metric supports the notion that BTC has the potential to climb higher before reaching a market top, aligning with other bullish indicators.

4. Technical Breakouts and Positive Market Sentiment

Technical analysis reveals that Bitcoin has recently broken out of a descending channel and a pennant pattern, both of which are bullish signals. Such breakouts often precede upward price movements, suggesting that BTC may be poised for further gains.

Additionally, the Relative Strength Index (RSI) indicates strong momentum, although it's approaching overbought territory. While trading volumes remain below average, the overall market sentiment is positive, bolstered by factors such as institutional adoption and favorable regulatory developments.

Conclusion

The convergence of these four signals—significant accumulation by institutional investors and whales, decreasing exchange reserves, a favorable MVRV ratio, and bullish technical patterns—paints an optimistic picture for Bitcoin's price trajectory. If these trends persist, BTC could very well reclaim the $100,000 mark in the near future.

Read more: Strategy Buys Additional $180 Million in Bitcoin: Reinforcing Its Dominance in the Crypto Market